haven't filed taxes in 5 years will i still get a stimulus check

The agency has said it will continue to process stimulus checks throughout 2020 and to help people it has extended the deadline for people filing their 2019 income taxes from April 15 to July 15. Questions still linger for many including whether they need to submit new information in order to get that money.

Financial Safety Net More Than Just An Emergency Fund Emergency Fund Financial Personal Finance

Prepare to file all your returns and face the music.

. The IRS has stated that it will not garnish stimulus check payments for back taxes. Request penalty abatement if applicable. We have tools and resources available such as the Interactive Tax Assistant ITA and FAQs.

Havent Filed Taxes in 5 Years If You Are Due a Refund. If u havent filed for either year u will not be receiving a stimulus check. The IRS - who sends out the checks - will use your 2019 form to see how much money you should get.

However you can still claim your refund for any returns from the past three years. If you havent turned in. Get Your Act Together.

They are giving stimulus checks to tax paying citizens. If You Owe Taxes. The government will calculate the amount of money you receive based on your adjusted gross income on your 2019 tax return.

But this could mean youll receive less cash than youre entitled to in certain circumstances -. 2018 tax returns are used as a Plan B so if you have filed a return for 2019 you. Remember you now have until July 15 2020 to file your federal tax return and claim refunds.

They are gonna to base it off your 2018 or 2019 tax return. If you need help check our website. I file 2018 tax return and had to pay i receive social.

Create a template for future compliance. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The deadline for claiming refunds on 2016 tax returns is April 15 2020.

I havent filed like for ten years - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Government has just started disbursing the stimulus checks it promised to millions of Americans. But if you filed your tax return 60 days after the due date or the extended due date then you might have a bigger penalty.

Dont let the IRS keep any more of your money. Yes but you still must file your 2020 taxes. Whatever the reason once you havent filed for several years it can be tempting to continue letting it go.

For example if you need to file a 2017 tax return normally due on April 15 2018 the last day that you can obtain a refund for your 2017 withholding and other payments is April 15 2021. What you need to do is rectify the situation as soon as possible. I plan on doing both 2018 and 2019 here in.

After May 17th you will lose the 2018 refund as the statute of limitations prevents refunds after three years. As of yet though the bill has not passed so that could change but currently thats how the bill is written. Get help preparing this years taxes.

The most common question were getting is If I have not filed my 2020 taxes will I still get my check The answer is YES. Thus you are legally entitled to the money if you meet the eligibility requirements. Partner O G Tax.

I havent filed 2018 taxes yet I probably wont get a stimulus check will I. People may get behind on their taxes unintentionally. If I havent filed taxes in years will i still get a stimulus check.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800-TAX-FORM 800-829-3676. Your penalty will now be the smaller of 135 or 100 of your total tax debt. Its worth noting that the penalty for not filing your taxes is ten times the penalty for filing but failing to pay.

I had a lot of personal obstacles last year and never filed my taxes. While the IRSs website will help you get a stimulus check as a non-filer other online resources can also help you file this years taxes. These penalties combined can accumulate over time up to 475 of the tax bill.

Locate and gather the financial records required for each return. The worst that could happen is that you could go to prison for tax evasion which can be as much as five years and 250000 in fines. This penalty is usually 5 of the unpaid taxes.

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the required return. Its too late to claim your refund for returns due more than three years ago. I file 2018 tax return and had to pay i receive social seccurity so direct deposit but i have move to another state since late year how will i get my check from stimus check.

Perhaps there was a death in the family or you suffered a serious illness. However not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term. The penalty charge will not exceed 25 of your total taxes owed.

You may still be able to get a third stimulus check if you havent filed one. Years with tax balances due will have penalties such as the failure to file and failure to pay penalties. The IRS is using 2019 tax returns to gauge peoples incomes.

The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid. We are in the middle of tax filing season so dont worry.

Financial Safety Net More Than Just An Emergency Fund Emergency Fund Financial Emergency

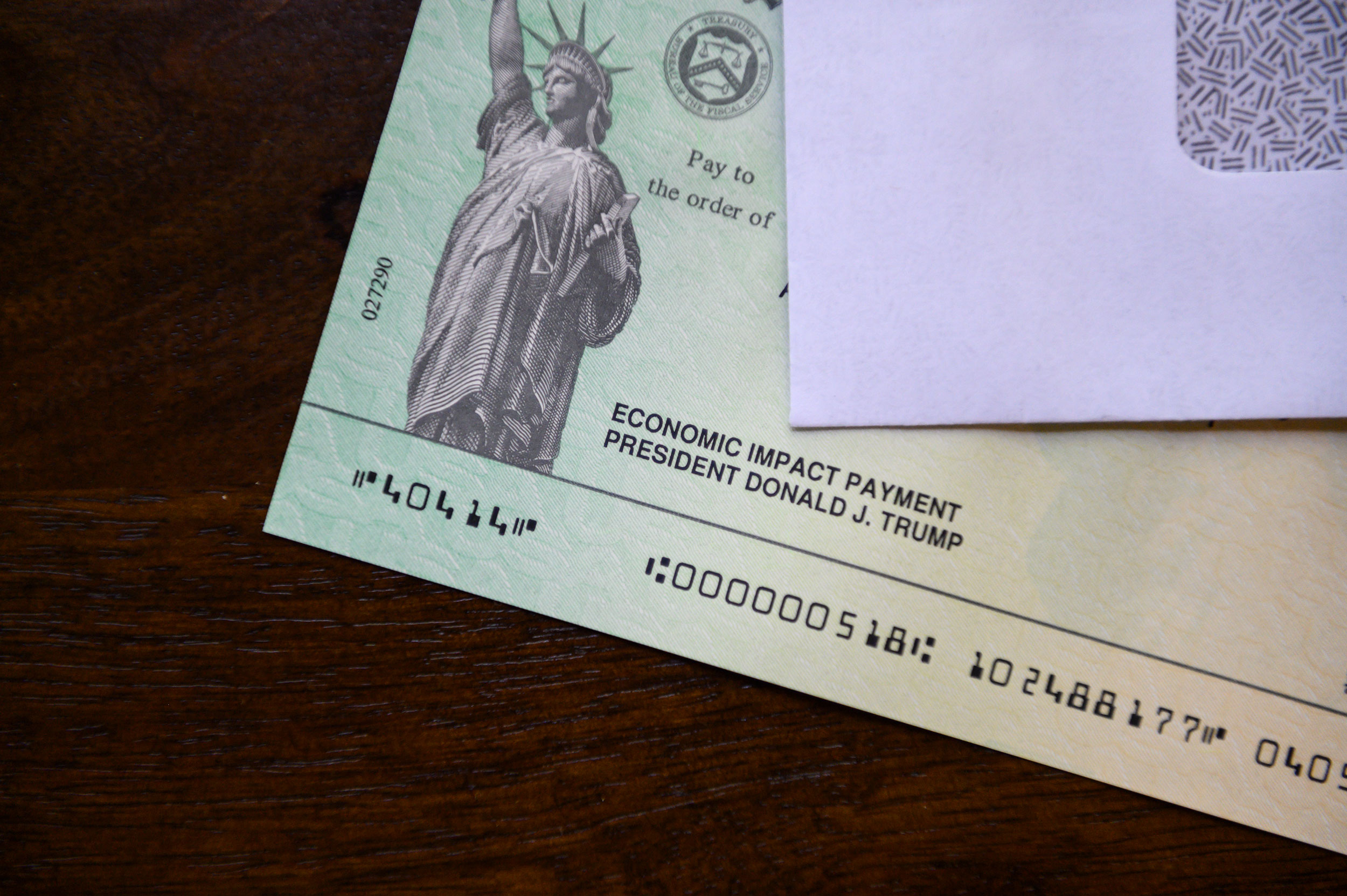

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Com

If The Check S Not In The Mail You Ll Have To Get Your Stimulus Money On Your Taxes

What To Do If You Haven T Received Your Stimulus Check Yet

Second Stimulus Check Update Stimulus Checks In August Ssi Irs Debit Cards Student Loans More Youtube Student Loans Irs Checks

Will You Still Receive Your Stimulus Check If You Haven T Filed Your Taxes 7 On Your Side Answers Abc7 New York

Financial Safety Net More Than Just An Emergency Fund Emergency Fund Financial Emergency

Will You Still Receive Your Stimulus Check If You Haven T Filed Your Taxes 7 On Your Side Answers Abc7 New York

Stimulus Payment What To Do If You Still Haven T Gotten Your Check Cnn Politics

Irs Says You Don T Need To Do Anything To Get Your Stimulus Check And Answers Your Other Questions

Timing Income Tax Filing Just Right Could Mean A Bigger Stimulus Check

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

Pin On Financial Freedom The F I R E Way

Will You Still Receive Your Stimulus Check If You Haven T Filed Your Taxes 7 On Your Side Answers Abc7 New York

Pin On Financial Freedom The F I R E Way

Here S How To Get Your Stimulus Check By Direct Deposit Key Dates Deposit Tax Refund

Saving Money On Groceries Busted Up Bill In 2021 Saving Money Grocery Grocery Savings

Stimulus Checks Waiting For People With Little Income And No Income