davis county utah sales tax rate

Property taxes are assessed and collected locally. Utah collects personal income tax.

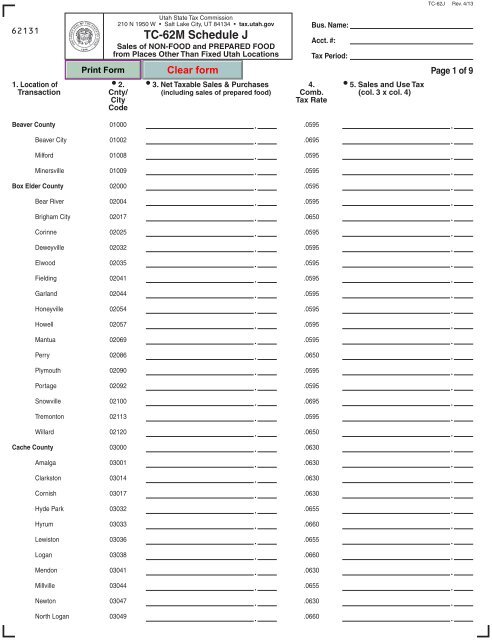

Tc 62m Schedule J Utah State Tax Commission Utah Gov

To find out the current sales tax rate in your locality see Utah Sales Use Tax Rates.

. The state sales tax has a base rate of 645 percent with cities and counties levying additional local sales taxes that vary among the municipalities. Since 2008 the tax has been a flat five percent for all taxpayers. All other trades are valued and are subject to tax.

The purchase price should be listed on the title being transferred on a bill of sale.

Utah Sales Tax Rates By City County 2022

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax Rate Increases Take Effect April 1 2019

Found On Bing From Homemade Ftempo Com Entrance Design Supermarket Design Architecture